Banker Sentiment Remains Positive as Profit Concerns Emerge

By Michael L. Stevens, CSBS Senior Executive Vice President

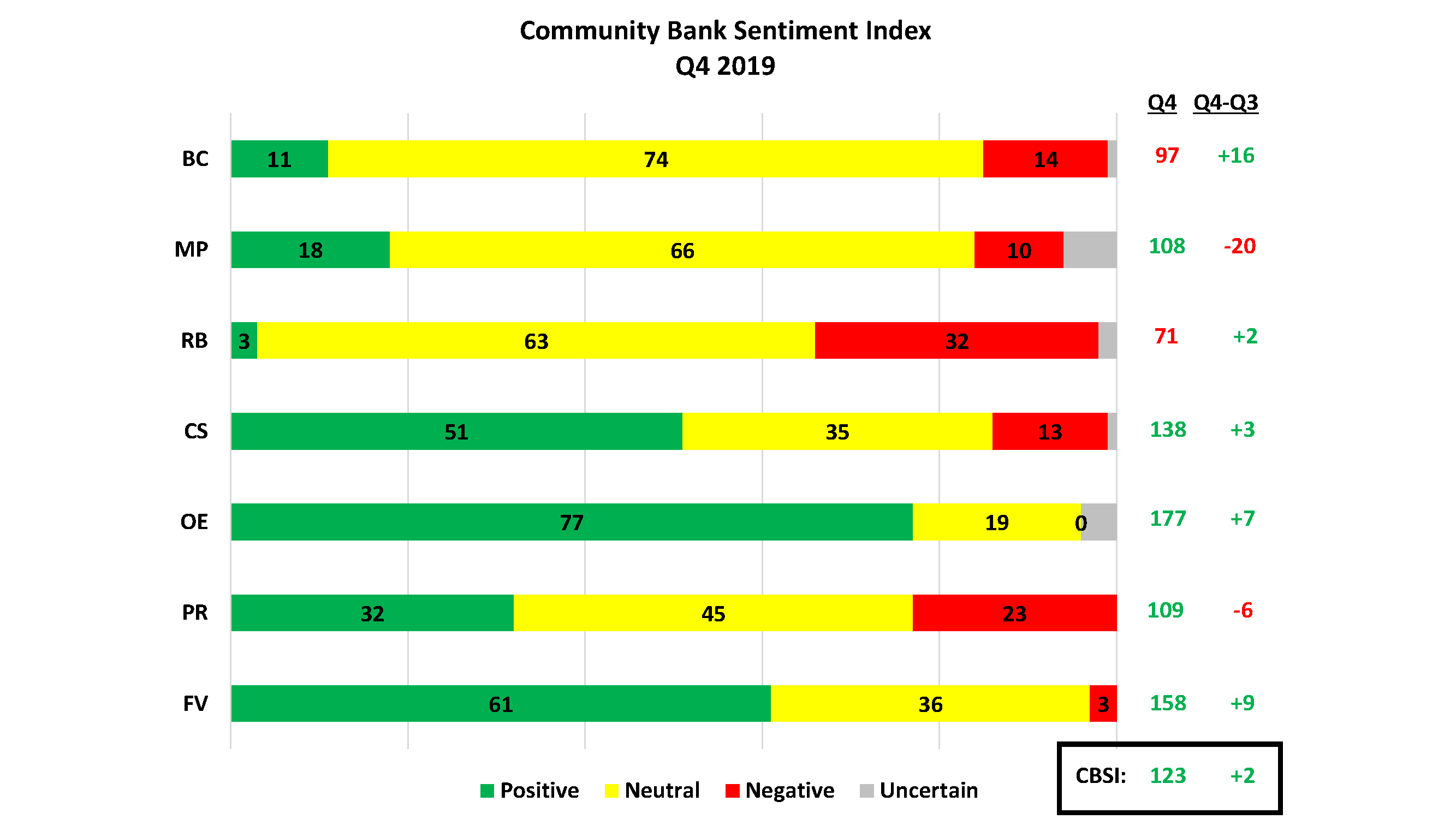

The fourth quarter Community Bank Sentiment Index (CBSI) had a slight uptick to 123, reflecting an overall positive outlook for the economy and community banks. This quarter 208 bankers from 43 states participated in the survey, providing a good geographic mix.

The index, first calculated in the second quarter of 2019, has been in a narrow band of 121 to 123. Absent a significant economic shock, we expect modest changes to the overall index from quarter to quarter. The real story lies in the change of the components and their impact on the index.

Banks continue to project strong levels of capital spending and operations expansion. Future business conditions are viewed more neutral and less of a drag on the index. This positive movement was offset by a large downward change in the monetary policy component wherein community bankers foresee a more stable, and less uncertain, monetary policy by the Federal Reserve.

One area worth watching is the declining trend of the outlook for profitability, with the overall score approaching neutral. As we dive deeper into the data, we will determine if this is more pronounced in certain areas of the country. The industry has had strong financial performance for several years, so a neutral outlook is not necessarily bad. However, there is no bottom to a negative trend, so this is worth watching in the 2020 quarterly surveys.

The CBSI was created in 2019 to capture what bankers are thinking about the future and is a direct result of the work CSBS has done with the Federal Reserve and FDIC on the Community Banking Research and Policy Conference. This local perspective has the opportunity to be an important indicator of economic activity for policy makers, bankers, and the market.

The Community Bank Sentiment Index is an index derived from quarterly polling of community bankers across the nation. As community bankers answer questions about their outlook on the economy, their answers are analyzed and compiled into a single number. An index reading of 100 indicates a neutral sentiment, while anything above 100 indicates a positive sentiment, and anything below 100 indicates a negative sentiment.

The index is calculated based on community banker expectations in seven key areas:

1. Business conditions

2. Monetary policy

3. Regulatory burden

4. Capital expenditures

5. Operations expansion

6. Profitability

7. Franchise value

The next data collection will kick-off on March 2. Any bankers interested in participating in this five-minute survey should email [email protected].